The Future Looks Bright for AR/VR/MR in 2023 & Beyond

It’s that time of year when industry analysts and prognosticators are sharing their predictions and projections, identifying “trends to watch” and forecasting market dynamics for the coming year(s). The extended reality (XR) industry, encompassing augmented-, virtual-, and mixed/merged-reality (AR/VR/MR) technologies, is no different.

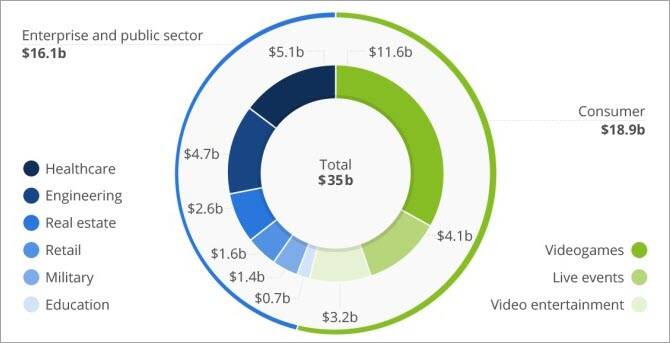

The latest AR/VR market forecasts say that the industry will earn $13.8 billion in revenues for 2022 and grow to $50.9 billion in 2026, a five-year compound growth rate of 32.3%.1 This projected growth is significant, building on the multiple ways AR/VR technologies are already being used by a wide range of industries.

*Base case scenario. (Data Source: Goldman Sachs Global Investment Research, Image © Statista)

In previous posts we’ve looked at some AR/VR educational uses, office workplace adoption, industrial AR applications, and more. The power of XR devices and technologies is, just like computers or phones, they provide a foundational technology platform that people can use for a vast range of activities.

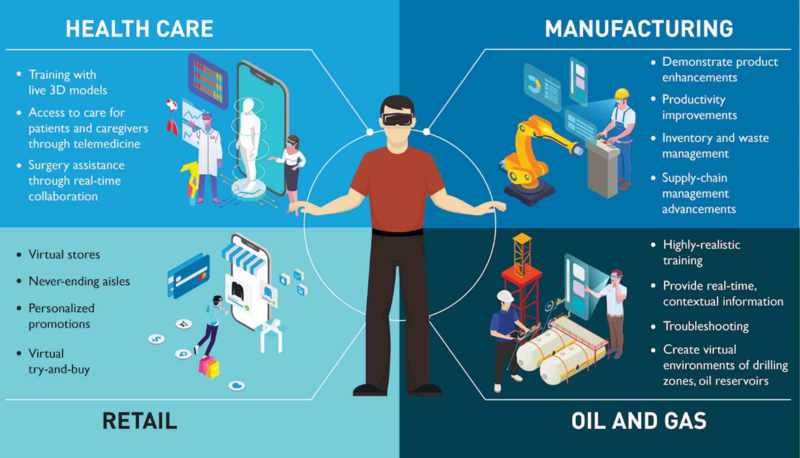

Four of the key industry segments that are using AR/VR technologies include healthcare, retail, manufacturing, and oil and gas. (Image © Harman).

Increasing AR/VR in Daily Life

Every human on the planet needs to access healthcare at various times, so it’s no surprise the healthcare/medical industry is quickly taking advantage the diagnostic, patient education, surgical visualization, treatment therapies, and other medical applications of AR/VR technologies. In fact, the healthcare market for AR/VR is projected to grow at a compound annual growth rate (CAGR) of 26.88% by 2030, reaching roughly $19.6 billion in revenues.

Another industry jumping on the AR/VR trend is retail. Along with much of the U.S. economy, consumer shopping drives the market as retailers scramble to adapt to the ever-changing retail landscape of brick-and-mortar stores, online retail, pop-up shops, Instagram influencers, and consumer demands to “try before they buy”—even if the tryout is virtual. The newest technology is so-called “smart mirrors” that will allow in-store customers to virtually try on clothing items through AR/VR technology built into mirror-like displays.

The gaming industry has, of course, been the largest segment of AR/VR since the beginning, and that’s not likely to change any time soon. But another entertainment application is on the rise: immersive sports and events. From virtual stadium tours to live streaming from the stage at concerts, to courtside seats at a basketball game with stats and info displayed in real time, venues and media companies are getting creative. This market is predicted to grow from $2.3 billion in 2020 to more than $56 billion in 2030.

AR/VR Trends to Watch

Other predictions for the year ahead in the XR realm include:

The Metaverse is emerging. Analysts believe that the upcoming release of the Meta Quest Pro headset will spur more growth in the metaverse in 2023 with improved avatars and other features. The industry foresees strong growth of 39.8% CAGR through 2030.

AR and AI will become more closely entwined. AR applications must continually gather information about the user’s surrounding environment via multiple sensors. “Complicated algorithms must be used to make sense of sensor data of the environment. AI can simplify that process and make it more accurate than a model made exclusively by a human.”

AR navigation will take off. Trying to find your way around a campus, shopping mall, or on the city streets? AR-enabled navigation promises to improve on previous technologies such as GPS. The advantage is that AR can potentially provide users with directions based on the specifics of their environment, not just based on geographical coordinates.

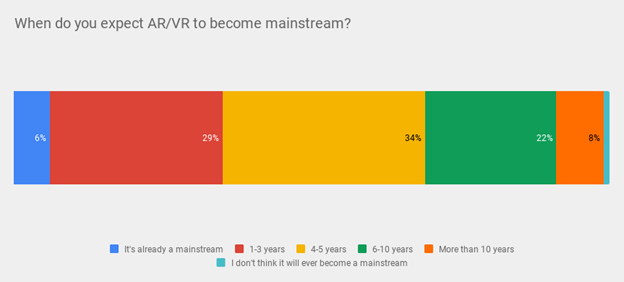

Of course, the mega-trend in AR/VR that the industry is hoping to see is widespread mass-market adoption of these technologies, but we’re not there yet:

A significant 69% of industry experts predict that we’ll see mass adoption of AR/VR within the next five years. (Source and image credit: Devabit)

User Experience is Key

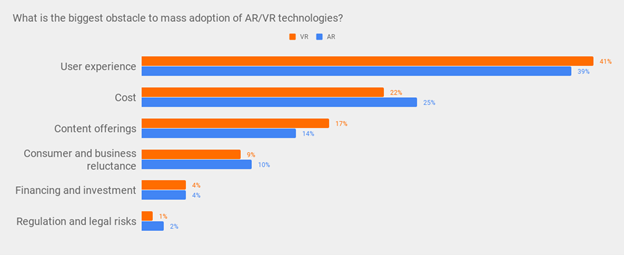

Of all the charts and graphs and data about the XR industry, perhaps the most important is the one below that shows “user experience” as the biggest barrier to adoption and market growth. “This reflects the ongoing concerns with technical limitations and performance issues as well as bulky hardware in the case of VR.”

(Data Source: Perkins Coie; Image Source: Devabit)

XR device displays are near-eye-displays (NEDs) that are viewed very close to the wearer’s eyes, directly in their field of view. As a result, defects in the display or projected images are quite noticeable. Quality issues such as dead display pixels or low image resolution impact the user experience.

Systems & Approaches for Quality Measurement of XR Devices

The ultimate determination of XR device quality is the user’s perception of the display. To accurately assess user experience, quality inspection needs to mirror the unique viewing parameters of the device’s design. All NED devices are viewed from close proximity to provide immersive experiences.

This viewing proximity is common across XR devices, but display technologies, projection methods, and headset hardware continue to evolve. New display test equipment is needed to address more diverse viewing conditions—different angular fields of view (FOV), resolutions, focus ranges, and hardware form factors that determine how each display is experienced. Visual inspection solutions must provide more flexibility to continue to capture meaningful details seen from the user’s perspective, using imaging and optics to evaluate display quality from the intended near-eye viewing position.

To learn more about quality evaluation of XR device displays, watch this on-demand webinar, A Flexible Solution for XR Display Testing: Replicating the Human Eye in More Headsets and Smart Glasses, originally presented at the DSCC (Display Supply Chain Consultants) 2022 AR/VR Display Forum. In the presentation, Optics Development Manager Eric Eisenberg discusses scientific imaging systems that emulate human vision for visual test and measurement of XR displays and introduces a new test system, the XRE Lens solution (patent pending). It incorporates flexibility in its optical design—electronic focus control, FOV options, and “folded” (“periscope”) geometries to accommodate different XR device focus ranges, display specifications, and form factors. Watch the presentation to learn more about:

- XR displays: Visualization parameters and quality considerations

- Test & measurement systems that emulate the human eye in XR headsets

- Measurement challenges posed by new XR device designs and capabilities

- New flexible measurement optics that simplify display testing across XR devices

CITATIONS

- IDC Worldwide Augmented and Virtual Reality Spending Guide, IDC, November 30, 2022.

- Augmented and Virtual Reality in Healthcare Market, report from Precedence Research, August 23, 2022

- Augmented and Virtual Reality Market with COVID-19 Impact Analysis, by Organization Size, Application, and Industry Vertical, Global Opportunity Analysis and Industry Forecast, 2021–2030, Allied Market Research, November 2019.

- Metaverse Market Size, Share, Trends, Analysis and Forecasts…2022-2030, GlobalData, September 30, 2022.

- “12 Augmented Reality Trends of 2023,” IOT for All, November 23, 2022.

- Blagojevic, I., Virtual Reality Statistics, 99firms.com blog. (Accessed December 8, 2022)

Join Mailing List

Stay up to date on our latest products, blog content, and events.

Join our Mailing List